Mutual Funds

What Is Mutual Fund?

Why Should you Invest in Mutual Fund?

Tax Benefits up to ₹46,800

Save up to ₹46,800 in taxes by investing in ELSS Tax Saving Mutual Funds.

Start with as low as ₹100

Kickstart your mutual fund journey with just ₹100.

Build wealth steadily with the power of long-term compounding.

Achieve long-term financial growth through the power of compounding.

Managed by experienced fund managers

Guided by SEBI-registered professionals, mutual funds offer transparency and relative safety for retail investors.

Why Invest in Mutual Fund With Poonam Securities?

Expert-Selected Top Funds

Easy SIP via UPI Mandate

Instant Lumpsum

Instant payout

How to invest in Mutual funds?

Just like pooling money to buy chocolates, you can invest in mutual funds directly through the fund house or AMC. This saves on commission costs, but managing multiple AMCs individually can be inconvenient.

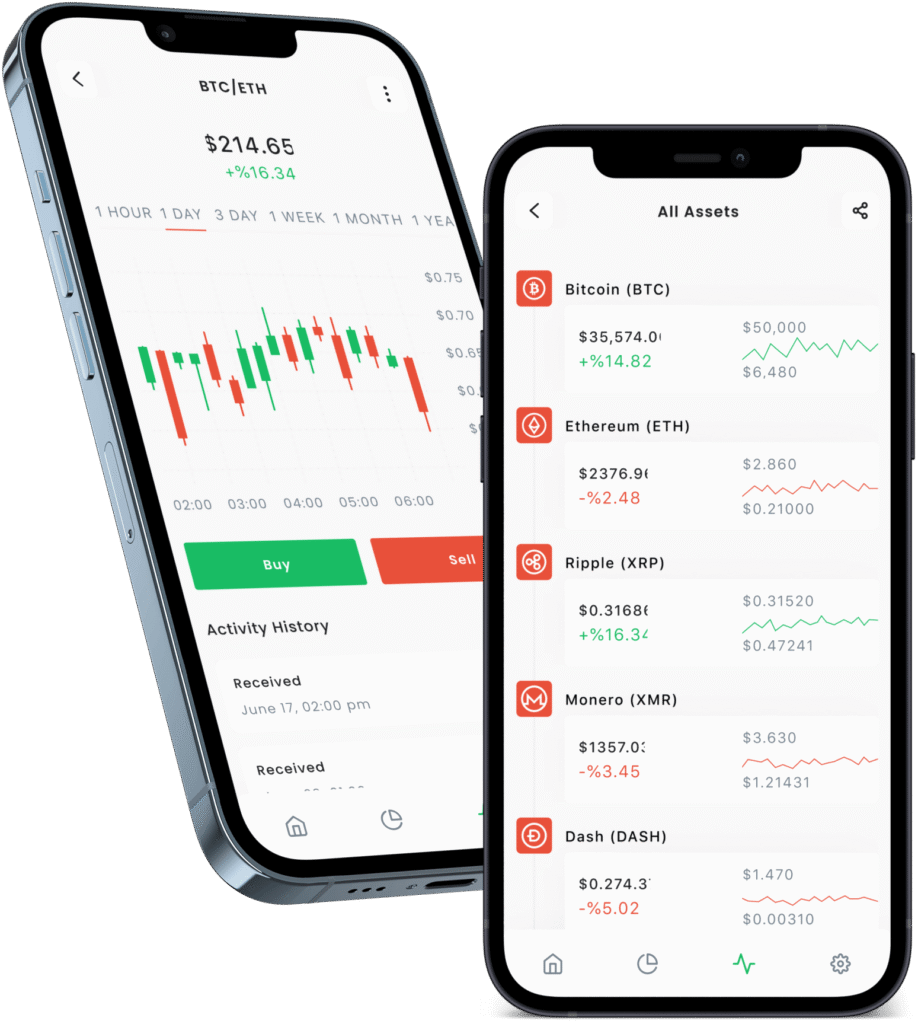

Much like online shopping, many investors prefer the ease of investing through online platforms or apps. These portals offer expert research, fund recommendations, and a single dashboard to manage all investments.

For investors seeking guidance, financial advisors help choose suitable mutual funds based on goals and risk profile. Brokers like Motilal Oswal often offer free advisory and personalised financial planning.

Robo-advisors are automated platforms that use algorithms to recommend and manage mutual fund portfolios based on your risk profile. They reduce human bias but may lack personal guidance.

1. Systematic Investment Plan (SIP)

Invest a fixed amount regularly (e.g., monthly) in mutual funds. SIPs encourage disciplined investing, benefit from rupee cost averaging, and help build long-term wealth through compounding.

2. Lumpsum Investment

A one-time, large investment in a mutual fund. Ideal for those with a significant amount ready to invest, often based on market timing or financial goals.

Did You Know?

Market Leader For A Reason

36+ Years of Robust Research

Trusted by 50L+ Customers

2,520+ Branches

1,100+ Investment Advisors

Type Of Mutual Fund

Mutual funds—equity, debt, hybrid, index, and ELSS—suit varied risk profiles and return goals.

Debt Funds

Debt funds invest in fixed-income instruments like government and corporate bonds. They offer regular interest income and are less risky.

Money Market Funds

Hybrid Funds

Index Funds

Sector/Theme-based Funds

Sector or theme-based funds invest in specific industries like tech, healthcare, or energy. They offer focused growth potential but carry higher risk due to limited diversification.

ELSS Funds

Equity Funds

Equity funds primarily invest in stocks with the aim of long-term capital growth. While they offer higher return potential, they also carry higher risk due to market volatility.

Complete Digital Process

-

Step 1

Enter your name and mobile number & enter the OTP received on the registered number

-

Step 2

Enter your details such as Date of Birth, PAN number, Email Address and Bank account details

-

Step 3

Complete Aadhaar KYC and mandatory E-Sign and you are all set to invest and trade

Document require to open a demat account

- PAN Card

- Aadhaar Card