Loan Against Securities

What Is LAS?

Why Should you Invest in LAS?

Instant Liquidity

Access quick funds without selling your investments.

Retain Ownership

Stay invested and continue earning potential returns while your securities are pledged.

Flexible Loan Amount

Based on the value and type of securities pledged.

Attractive Interest Rates

Competitive rates lower than unsecured loans.

Usage Freedom

Use the funds for business needs, emergencies, education, travel, or any personal purpose.

Why Invest in LAS With Poonam Securities?

Quick processing & transparent terms

Expert guidance tailored to your portfolio

Secure, SEBI-compliant processes

Trusted by individuals and business owners

Did You Know?

Market Leader For A Reason

36+ Years of Robust Research

Trusted by 50L+ Customers

2,520+ Branches

1,100+ Investment Advisors

Type Of LAS

LAS Against Equity Shares

Pledge your listed shares to raise short-term capital while continuing to benefit from market movements.

LAS Against Mutual Funds

Use your debt or equity mutual fund investments as collateral for a flexible and low-interest loan.

LAS Against Bonds & Debentures

LAS Against Insurance Policies

ETFs (Exchange-Traded Funds)

Sovereign Gold Bonds (SGBs)

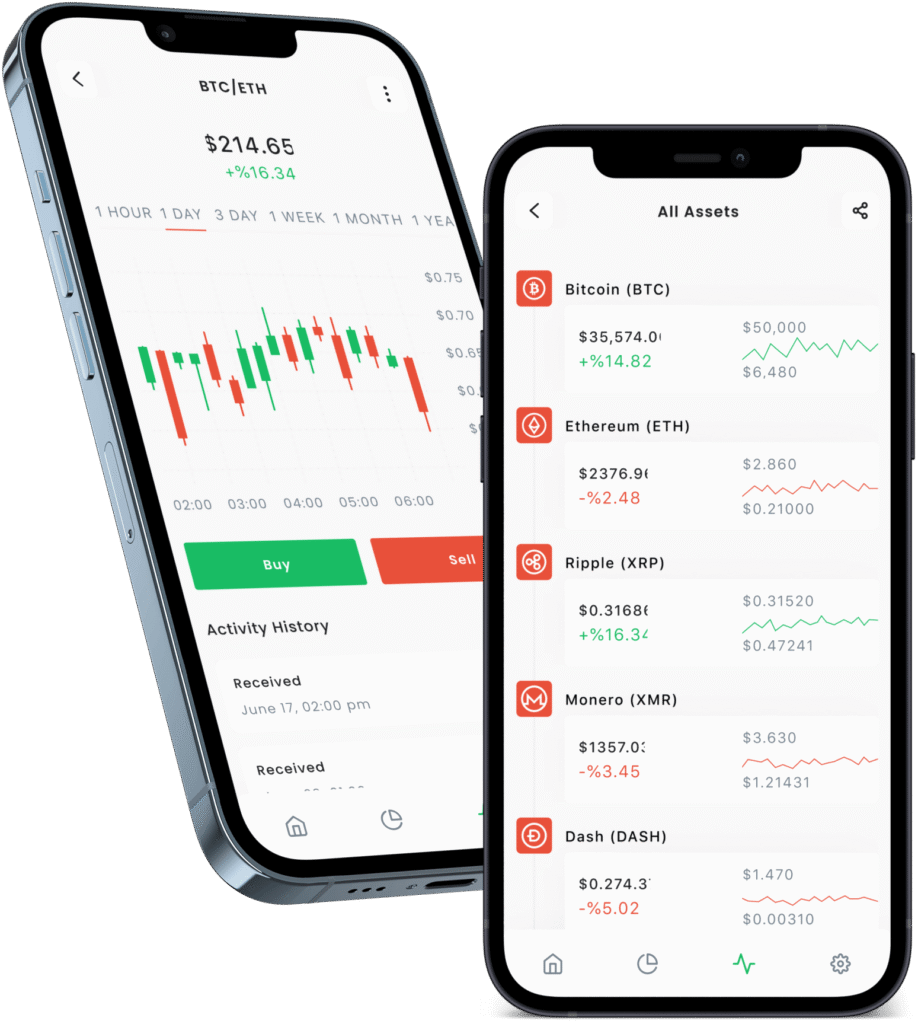

Complete Digital Process

-

Step 1

Enter your name and mobile number & enter the OTP received on the registered number

-

Step 2

Enter your details such as Date of Birth, PAN number, Email Address and Bank account details

-

Step 3

Complete Aadhaar KYC and mandatory E-Sign and you are all set to invest and trade

Document require to open a demat account

- PAN Card

- Aadhaar Card