Alternative Investment Fund

What Is AIF ?

Why Should you Invest in AIF?

No Need for a Demat Account

Avoid the paperwork—AIF investments don’t require a demat account.

Access to Unique Opportunities

Invest in exclusive, high-potential assets not available through traditional options.

True Diversification

Gain exposure to diverse asset classes like real estate, private equity, commodities, and stressed assets.

Fewer Regulatory Limitations

Execute advanced strategies like long-short positions with minimal regulatory constraints.

Why Invest in AIF With Poonam Securities ?

Trusted by 42,000+ investors

Multiple AIF Strategies

16K+ crores of Asset Under Management

3 Decades of experience in equity investments

AIF Categories to know

Category I

This category invests in start-ups, early-stage ventures, and SMEs with social or economic impact. It may get government support. Includes Angel Funds backed by HNIs and experienced investors.

Category II

Includes private equity and debt funds tailored for cautious investors, offering diversified and professionally managed portfolios. These funds invest in a mix of listed and unlisted debt instruments to balance risk .

Category III

These funds use advanced strategies like arbitrage, margin trading, and derivatives to earn high returns. Examples include hedge funds and PIPE funds, mainly focused on short-term gains through active trading.

Did You Know ?

Market Leader For A Reason

36+ Years of Robust Research

Trusted by 50L+ Customers

2,520+ Branches

1,100+ Investment Advisors

Type Of AIF

Equity & Private Equity

Multi-Factor AIF

Distressed Asset AIFs

Real Estate AIFs

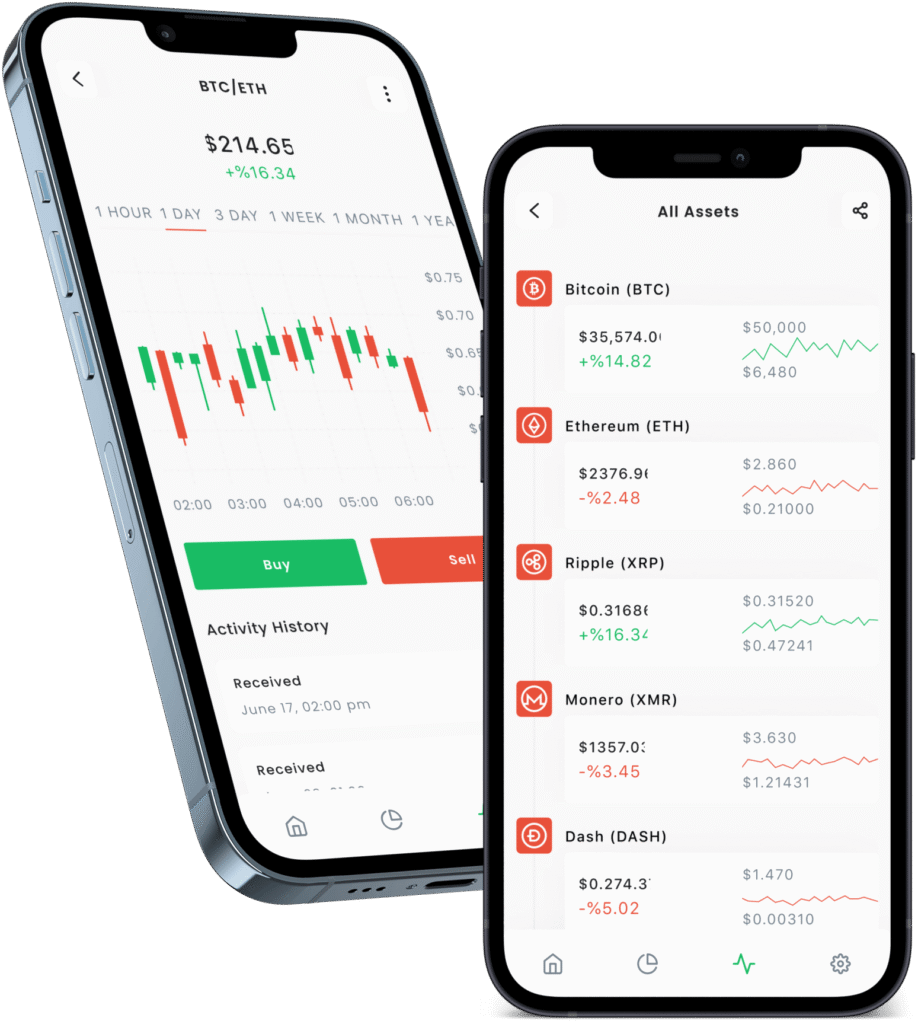

Complete Digital Process

-

Step 1

Enter your name and mobile number & enter the OTP received on the registered number

-

Step 2

Enter your details such as Date of Birth, PAN number, Email Address and Bank account details

-

Step 3

Complete Aadhaar KYC and mandatory E-Sign and you are all set to invest and trade

Document require to open a demat account

- PAN Card

- Aadhaar Card